Game intel

Banker Simulator

Banker Simulator is a single-player game where you revive a bankrupt bank. With active and passive (idle) gameplay, make strategic decisions to grow your bank,…

From the moment Banker Simulator landed in Steam Early Access in Q3 2025, I was all in. As someone who practically dreams in pivot tables, I’ve tried my share of economic sims—some lean too hard on data entry, others crush you for a single misclick. Banker Simulator promised something new: real adrenaline in financial decision-making. After a few demo sessions, I realized this wasn’t just another spreadsheet disguised as a game. It felt like living, breathing bank management, complete with pulse-pounding stakes.

My first hour was a roller‐coaster of joy and dread. Approving a high‐risk loan, watching the day/night cycle tick by as market indices swung, and then scrambling to cover margin calls—it all scratched an itch I didn’t know I had. Here’s a closer look at why this title has me checking my Steam wishlist daily.

Launching Banker Simulator for the first time throws you into a rundown branch lobby with a single teller window and a dusty credit office. A helpful tutorial guides you through basic loan approvals, account setups, and a simple investment palette. You’re given seed capital, a baseline staff roster, and a HUD showing real-time news bulletins.

Within minutes, I was toggling between the morning briefing and loan dashboard—already scheming my first high-yield gamble.

What sets Banker Simulator apart is its living economy. You don’t just click “approve”—you weigh a client’s spreadsheet, read breaking news scrolling on your in-game terminal, and watch markets react in real time. The day/night cycle isn’t cosmetic; overnight crashes can wipe out a quarter of your portfolio before you even roll into the office.

I once held a convertible bond position that plunged after a fictional sovereign default hit headlines during my lunch break. By the time I returned, the app alerted me to a 35% loss—and I had to decide instantly whether to liquidate or double down. Moments like that blur the line between game and genuine financial stress test.

Loan approvals in Banker Simulator aren’t checkbox exercises. Each applicant has a risk profile, sector exposure, and hidden red flags in their credit history. On day two, I faced a desperate tech start-up looking for a bridge loan. Their pitch glowed with promise, but the fine print hinted at negative cash flows.

That start-up loan went south two cycles later, teaching me to diversify rather than chase flashy opportunities.

Beyond loans, you allocate funds across stocks, bonds, commodities, and derivatives. A ticker tape runs along the top of your HUD, flashing bulletins—some real-world inspired, others purely fictional but believable. When an oil embargo hit in my game world, my energy holdings soared, only to crater when a rival bank cornered the market with futures contracts.

Hedging tools allow strategic hedges or leveraging positions, but every move incurs margin requirements. Miss a margin call, and you might have to fire-sell assets at a loss or inject emergency liquidity from your capital reserves.

Banking isn’t just numbers; it’s people. A customer satisfaction meter tracks wait times, approval rates, and complaint volumes. Long lines or denied mortgages generate negative press—visible in local newspapers you can actually read and react to.

Turning around a branch’s reputation felt rewarding—especially when a 5-star review in the fictional “Metro Finance Weekly” led to a spike in new customers.

Growth requires talent. You can recruit tellers, loan officers, IT specialists, and compliance experts. Staff have unique stats—sales acumen, risk awareness, or customer empathy. Pairing a sharp underwriter with a people-person teller can streamline operations.

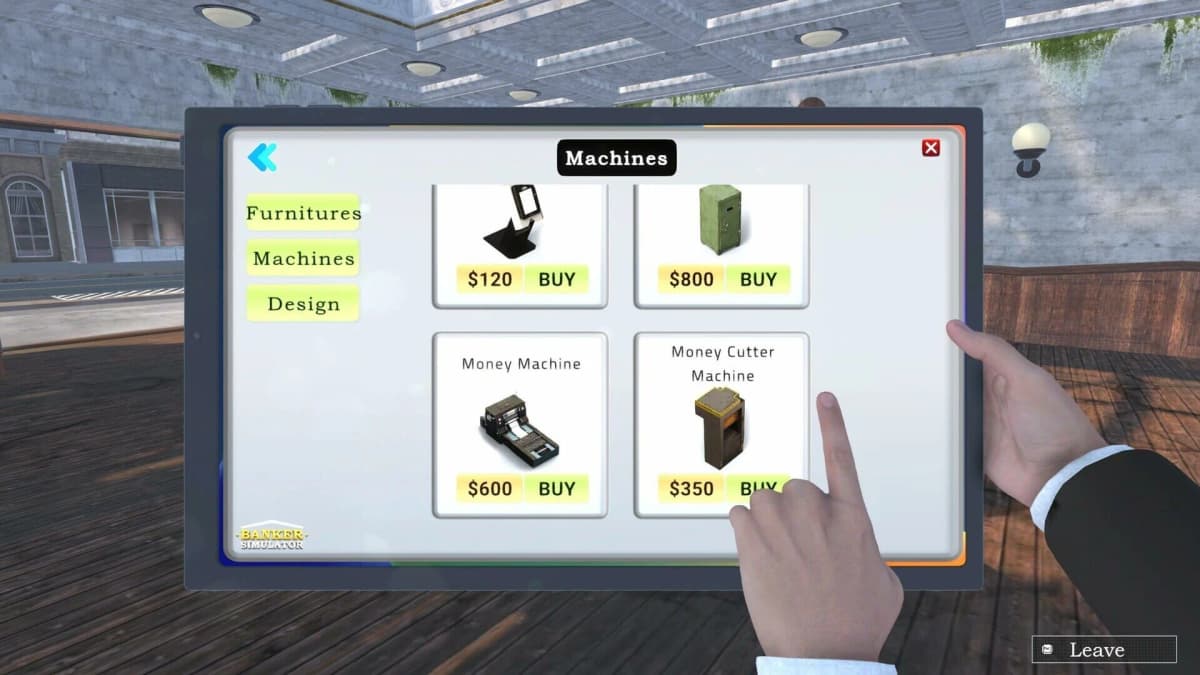

Facility upgrades include improved loan-processing software, advanced analytics modules, and client comfort features like auto-kiosks or VIP lounges. Each upgrade costs time and money, forcing tough budget priorities early on.

Beyond the scripted rags-to-riches arc, emergent events keep you on your toes. I encountered an anonymous tip about fraudulent transactions in my ledger, prompting an impromptu audit by regulators. Later, a simulated cyberattack shut down online banking until I deployed additional security protocols.

These events aren’t just flavor—they can derail months of progress or open unexpected profit windows if handled deftly. The thrill of racing against the clock to patch a security breach is real.

Ultimately, Banker Simulator asks: How do you balance growth, stability, and risk? Do you pursue aggressive M&A deals, or do you corner niche markets with specialized loan products? My favorite strategy so far has been establishing a micro-loan division for local entrepreneurs—low yield but high community goodwill.

The game’s open-ended sandbox means there’s no single “right” way to expand. Every bank you build reflects your personal approach to finance management, from conservative to cutthroat.

As an Early Access title, Banker Simulator shows promising polish but exhibits occasional hiccups. Loading times between day cycles can stretch five to ten seconds on mid-range rigs. A handful of AI pathfinding quirks occasionally leave customers wandering hallways. The developers have been responsive on Steam forums, promising optimizations and bug fixes ahead of the full launch.

Graphically, the game strikes a balance between functional UI elements and atmospheric office spaces. Ambient sounds—from ticking clocks to distant phone rings—enhance immersion without draining performance.

Simulation fans have plenty of options: City of Gangsters nails immersive crime economies, while Offworld Trading Company makes interplanetary resource markets thrilling. Banker Simulator’s first‐person approach and focus on real‐time banking events carve out a unique niche. If Soi Games can maintain emergent event variety and optimize performance, this could become the go-to title for finance aficionados.

Banker Simulator delivers a rare blend of spreadsheet rigor and pulse-pounding drama. Its deep loan systems, live market crises, and emergent events make every playthrough feel fresh. Early Access flaws—minor bugs, load times—are outweighed by the thrill of making high-stakes decisions. Mark your calendar for Q3 2025, and get ready to trade boredom for boardroom suspense. If you’ve ever wondered what it’s like to be a financial mastermind (or disaster), this sim will test your nerves—and maybe your portfolio—like never before.

Get access to exclusive strategies, hidden tips, and pro-level insights that we don't share publicly.

Ultimate Gaming Strategy Guide + Weekly Pro Tips